Is the Mendoza Line the Ideal Benchmark for SaaS Growth?

[ad_1]

At SaaS Capital, we constantly emphasize the importance of growth as the number one driver when it comes to valuing a SaaS company. Higher growth leads to better valuations. And, not surprisingly, it becomes harder to maintain higher growth rates as a company gets bigger. Growing your $1M ARR company by 100% in a year – while no mean feat – is a much less daunting task than growing your $100M ARR company to $200M over that same time frame.

What is a Good Growth Rate for a SaaS Company IPO?

But let’s flip the growth discussion on its head. We know that “more is better” when it comes to growth. But what is the minimum level of growth a SaaS company needs? Of course, the answer depends on the desired outcome, so for now, let’s define the desired outcome as the ever-elusive IPO. Anyone like baseball?

Enter Mario Mendoza and the Mendoza Line. First, a little background on the famed “average” Major League shortstop. Despite decent ability on the field, Mendoza struggled as a hitter, with his batting average falling below .200 in 3 of his first 4 seasons. Mariner teammates teased him for his poor hitting ability, and somewhere along the way the phrase the “Mendoza Line” was coined.

The Mendoza Line is the average hitting percentage below which a player is likely not (or no longer is) MLB material (**Note: this rule applies only to position players. Pitchers, for example, have an average batting percentage of just .131). More broadly speaking, the phrase “Mendoza Line” has been used to convey baseline performance generally.

So, then, what is the equivalent of the “Mendoza Line for SaaS companies?” Veteran software VC Rory O’Driscoll of Scale Venture Partners proposed a theory to identify the growth rate below which a company may not be on the VC-to-IPO trajectory.

Rory started with an analysis of SaaS companies at the time of IPO. At IPO, companies had a minimum run rate ARR of $100M and at least a 25% forward growth rate. He then examined growth rates over time and observed that within this data set, not only did growth rates slow over time; they tended to do so predictably: public SaaS companies grew at 80-85% of their previous year’s growth.

Applying this observation by doing the math backwards, this means that at scale, a best-in-class (i.e., “above the Mendoza Line”) SaaS company with $10M of ARR needs to be growing at a minimum of 77% to allow enough time to compound growth, inclusive of the decline, to stay on a $100M, 25% growth IPO trajectory.

By all accounts, this is hard – really hard – to do. And, like most oversimplifications, the theory has flaws, outliers, and exceptions. But that doesn’t diminish the value of the rule when it comes to quickly taking the temperature of your SaaS business: all else equal, if your SaaS company sits above the Mendoza Line, you are likely playing the game at an elite level.

Current SaaS Growth Rate Benchmarks

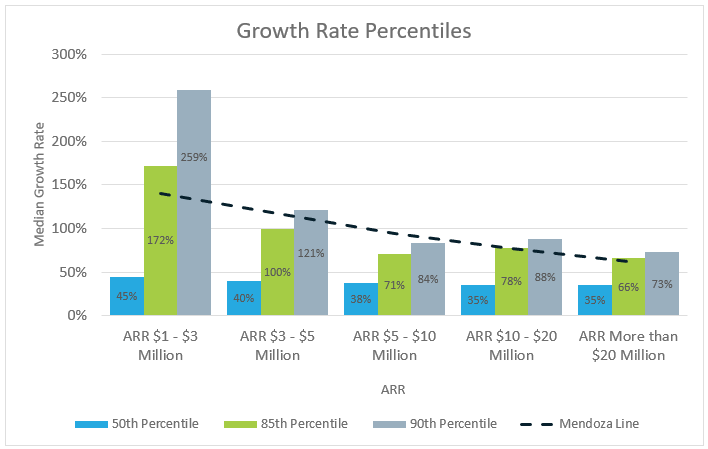

We were curious how this metric applies to the much broader market of successful, but not VC-to-IPO superstar SaaS Companies. So, we applied the theory to the companies surveyed in our annual survey of private SaaS companies. Here is where our respondents stack up:

As you can see, the Mendoza Line runs through our survey population, with the top 10% of companies in all but one category sitting at or above the Mendoza Line. As we would expect, companies in the $1 – $3 million ARR category have a greater percentage – 20% – of outperformers. It’s not surprising that the majority of our respondents sit below the line. After all, nearly 50% of our respondents have either never taken in outside equity or have only raised angel rounds.

These bootstrapped companies generally have less equity to fund big losses aimed at boosting growth, but in many cases, they are operating at or closer to profitability – with minimal founder dilution – a worthy accomplishment in its own right.

Should you care if your SaaS company’s growth rate falls short of the Mendoza Line? Probably not. Not every company is supposed to – or wants to – IPO. While the prestige and financial rewards of taking a company public are alluring, there’s additional risk and dilution that come with putting the company on a VC-fueled rocket ride. The worst outcome for everyone – founders, employees, and investors – is when too much equity capital is shoved in to try and force a company over the Mendoza Line. That fork in the road leads to down rounds, “broken” cap tables, and grinding losses.

SaaS Path to Success

Fun fact: Mario Mendoza went on to play in the Mexican League and was given the nickname “Silk Hands” for his fielding skills; he later embarked upon a successful managerial career. Even better, he was inducted into the Mexican League Hall of Fame. VC-fueled IPOs are not the only path to success. A great many founders would be better served by ignoring Mendoza’s line and instead following his example – choosing a path to success on his own terms. Betting on the odds, to strive for a sustainable business strategy over the long term beats chasing the IPO and fizzling out along the way.

![]()

[ad_2]

Source link