What Is a Good Monthly Growth Rate in SaaS?

[ad_1]

“When you stop growing, you start dying” said William S. Burroughs. That’s just as true for SaaS startups as it is for life. Growth is key to building any successful SaaS startup.

So, what is a good growth rate for a SaaS subscription business? In this post, we analyze anonymized and aggregated data from ChartMogul to find the answer. Later, we provide an overview of segments, and share insights on how they can help you unlock your startups’ growth.

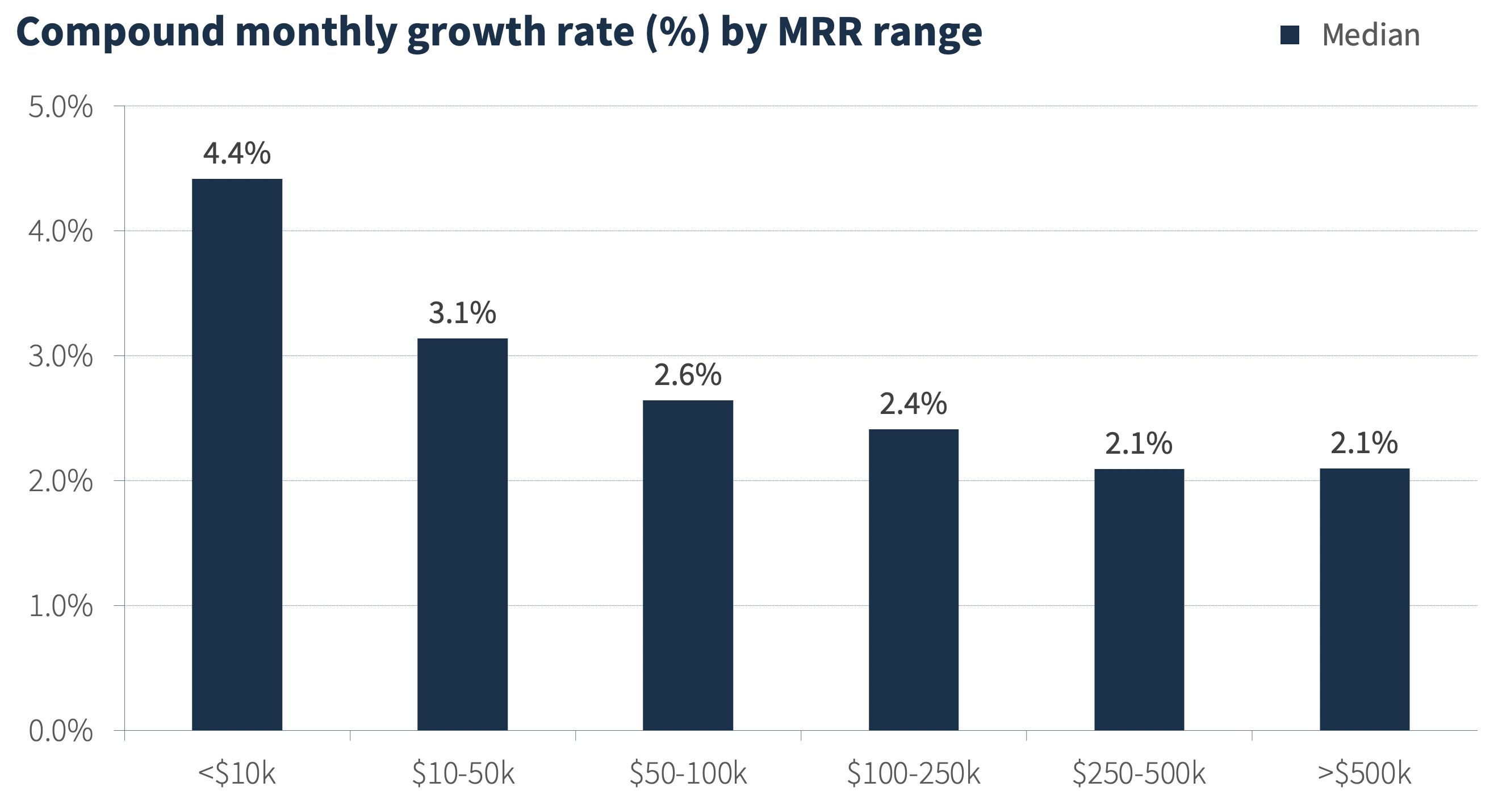

Compound monthly growth rate by MRR range

The chart below shows the median compound monthly growth rate (CMGR) for SaaS startups split by monthly recurring revenue (MRR) range.

In the very early days (<$10k MRR), a SaaS startup grows on average by 4.4% every month. That’s 68.0% annualized. As it continues its march towards the $50k MRR mark, it grows by 3.1% every month or 44.9% annualized. Over time, as the company reaches a sizeable revenue, growth slows down a bit but remains well over 2% per month.

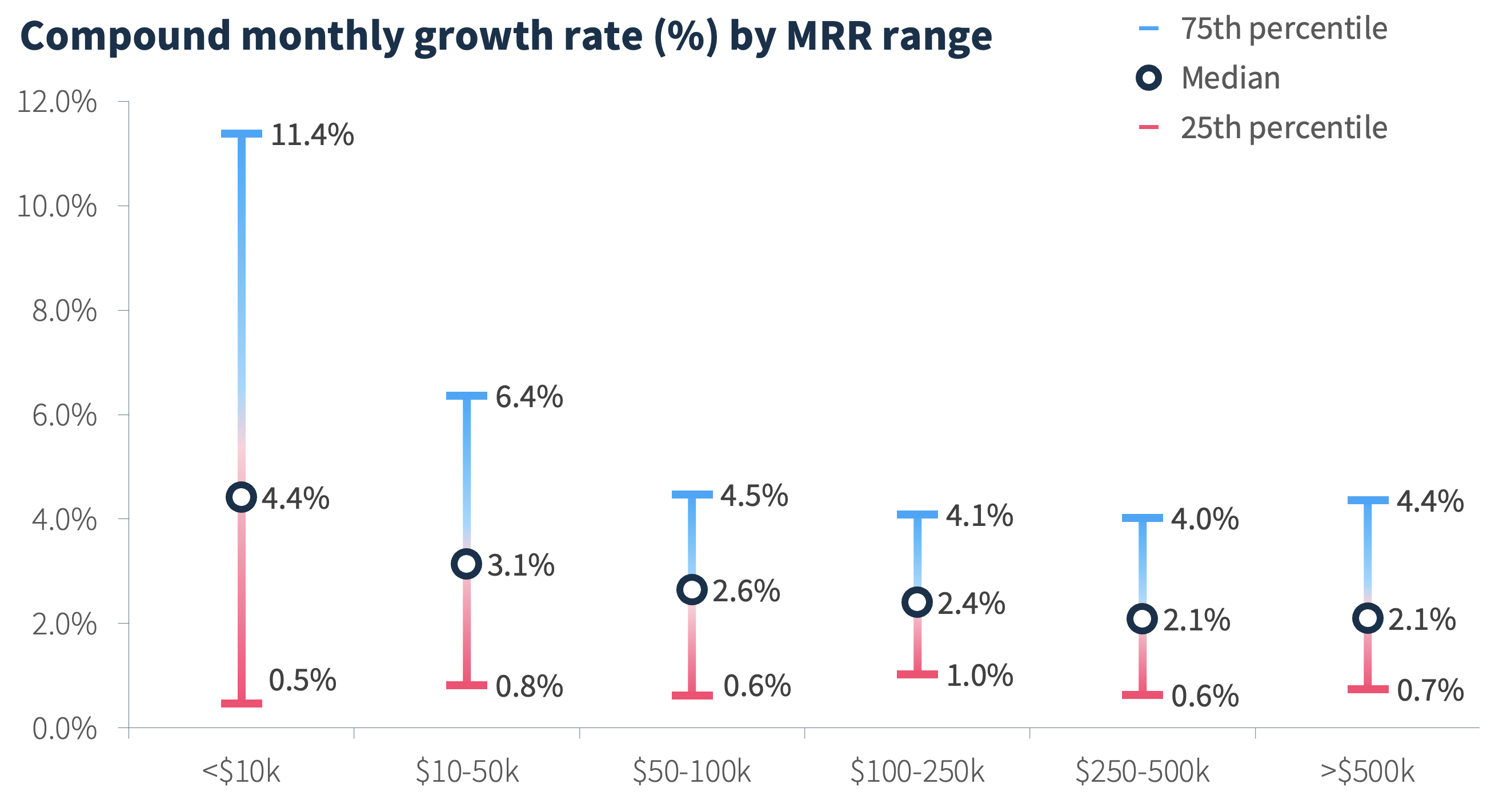

The chart below shows the 25th and 75th percentile of CMGR, in addition to the median. The top section in light blue is the 75th percentile. The blue dot in the middle is the median. And the bottom section in pink is the 25th percentile.

As you can see, the dispersion in growth is highest in the early stages. The fastest startups outgrow slower ones multiple times over. This is expected, as some startups find product-market fit (PMF) and start scaling, while others keep searching for it.

Calculation Methodology. We calculated CMGR using the following formula.

We limited the duration of the analysis to the past 12 months. In our opinion, if you analyze data older than 12 months, you start to encounter issues such as 1) the economic scenario changing or 2) the company jumping from one MRR band to another.

Factors that influence your growth rate

Many factors influence the growth rate of your SaaS startup, some of which are:

When looking at the various stages in the customer lifecycle, it’s important to understand all aspects of the funnel. Optimizing each stage will eventually lead to your desired growth rate.

Unlocking growth using segmentation

Growth is a key element on your road to success. Here’s why segmenting your data is important to unlock that growth, and gain further insights.

Why do SaaS businesses need segmentation?

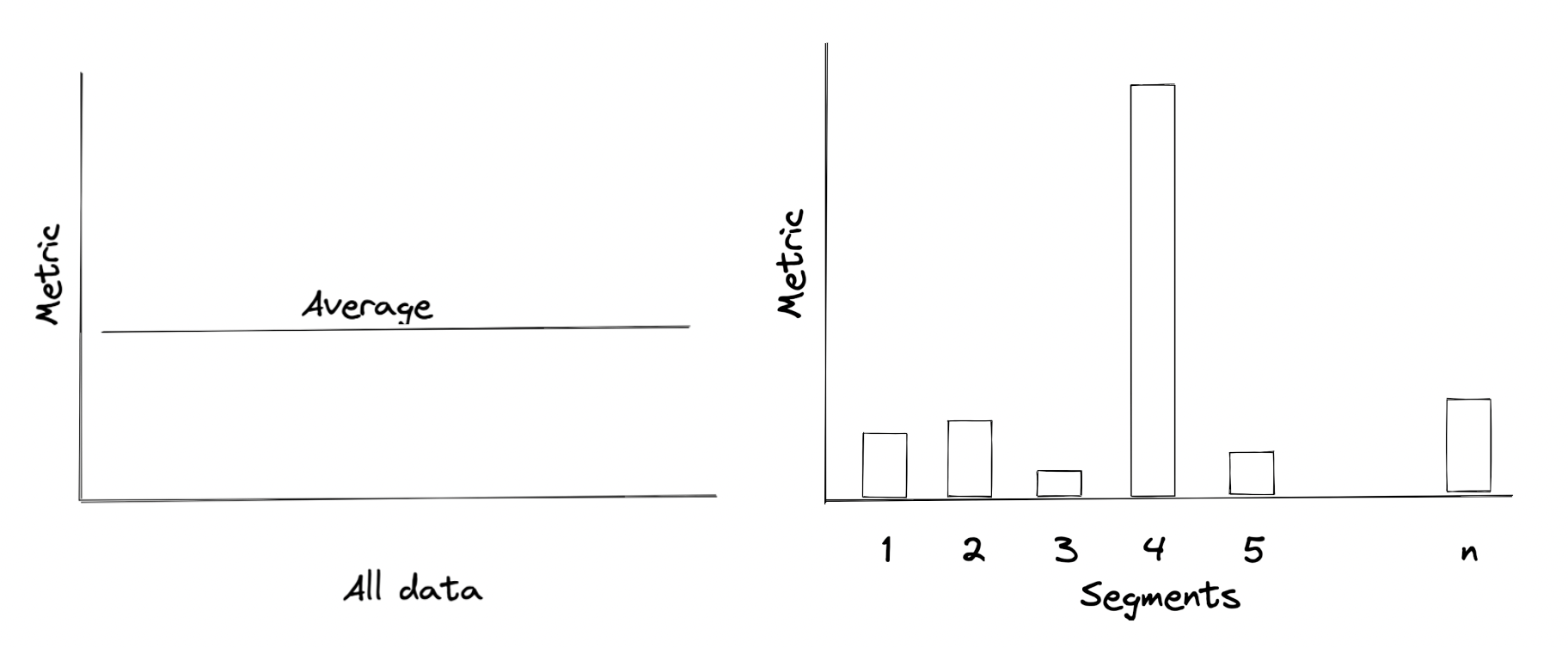

Overall metric averages are helpful to see directionality, but they often mask the underlying segment dynamics. For example, the chart on the left below, shows you a metric (say MRR) on average. Whereas the one on the right shows you the same metric split by segment of customers. Clearly, the second chart tells a more interesting story. It highlights that Segment 4 customers are the ones that you are getting the most MRR from, so you should double down on acquiring them (given they have the same acquisition cost)!

Segmentation is how HubSpot grew its business, as well. Brad Coffey, former Chief Strategy Officer at HubSpot shares their story.

At HubSpot, we started to see some of our biggest improvements in unit economics when we started segmenting our business and calculating the LTV to CAC ratio for each of our personas and go to market strategies.

As one good example – when we started this analysis, we had 12 reps selling directly into the VSB market and 4 reps selling through Value Added Resellers (VARs). When we looked at the math we realized we had a LTV:CAC ratio of 1.5 selling direct, and a LTV:CAC ratio of 5 selling through the channel. The solution was obvious. Twelve months later we had flipped our approach – keeping just 2 reps selling direct and 25 reps selling through the channel. This dramatically improved our overall economics in the segment and allowed us to continue growing.

Brad Coffey, former Chief Strategy Officer at HubSpot

Creating customer segments

Segmentation is an art on its own. It can be a challenge to create meaningful, actionable segments; however, there are some well-worn segments you can start looking at right away:

- By geography i.e. by country or region that shares unique characteristics

- By plan or product line

- By marketing/acquisition channel

- By usage metrics (last login, using a certain feature, etc)

- By company stats: size, industry, funding, etc

- By satisfaction metrics such as NPS score

Each of the above segments can be tested against their impact across each of the key SaaS metrics — conversion, MRR, Lifetime Value, Churn etc.

Segmentation is powerful, and can help you identify areas that you should focus on to unlock more growth. Learn more about getting started with segmentation in ChartMogul with this guide. Log in to your account or start your 14-day trial today.

Further Reading

[ad_2]

Source link